Written by: Sophia Wahl

The first few semesters of college can be overwhelming in many ways. For most of us, one of the most pressing issues is finances. If you’ve been stressed about these things, here are some tips!

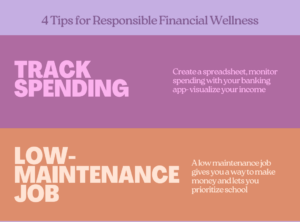

First, saving money is one of the most important aspects of college life. With tuition, food, gas, and more, it can be difficult to spend money responsibly. I have four tips for responsible financial wellness! First, track your spending. Whether you prefer the organization of a spreadsheet or utilizing your banking app’s spending analysis, it’s imperative to have an idea of how much you are spending. It also lets you visualize your income. Don’t forget about your subscriptions! They add up fast.

Finding low-maintenance jobs is one of the best things I’ve done in college. Whenever I get the chance, I log into work or sign up for shifts at the KTIS call center during fundraisers. Additionally, many students will find jobs or internships on-campus and become a Teacher’s Assistant, KTIS Intern, or Lab Assistant, just to name a few positions. Having a low-maintenance job gives you a way to make money and still prioritize school.

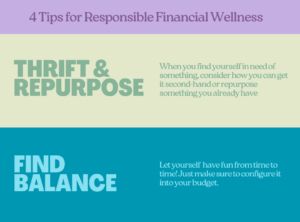

Third, thriftiness is key to cutting back on spending. If you find yourself in need of clothes, an appliance, or furniture, a second-hand store is the way to go! Additionally, repurposing things you already have promotes creativity and forces you to take a step back and consider what you do and don’t need.

Finally, find a balance between saving your money, buying essentials, and treating yourself. Depending on your income, a daily, weekly, or monthly plan for how much you are willing to spend on nonessentials gives you ease of mind when a fun opportunity comes up. You will know exactly how much you can spend and how much wiggle room there is.

With these tips and mindsets, you will be more prepared for the money-related challenges that will come your way.